Payday Filing, sorted now and always

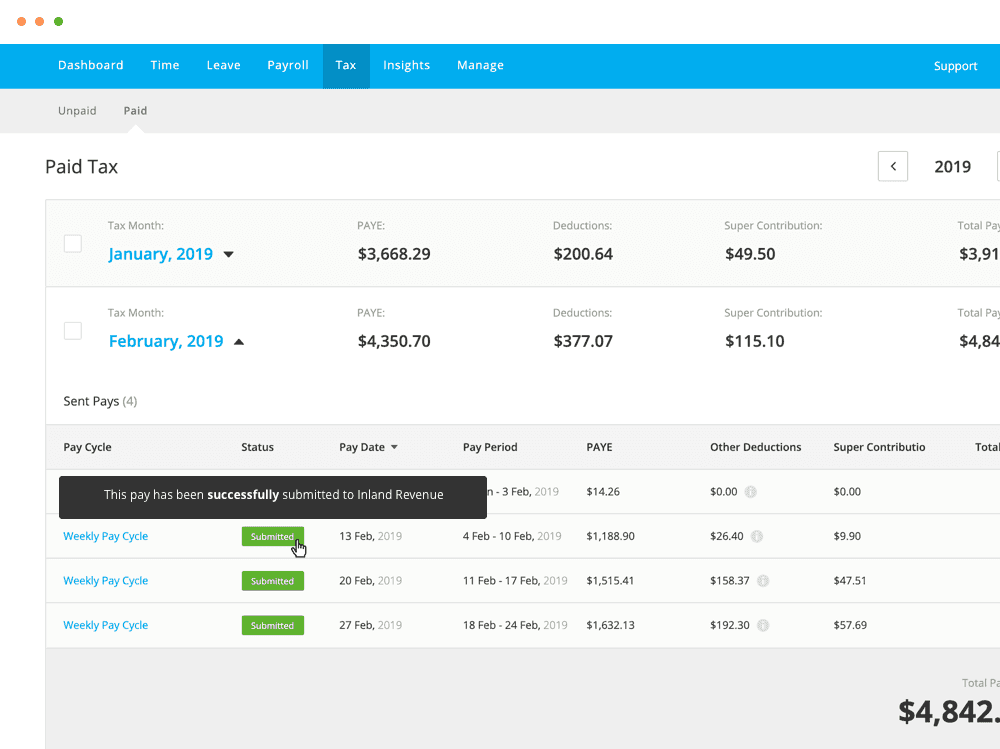

No need for extra admin with PayHero’s payday filing. Not only do we calculate your payroll taxes, we’ll also file them with Inland Revenue every time you pay your staff.

Fully automated

The easiest way to manage payday filing is to let our payroll software do it for you. It’s 100% automated so you’ll never need to think about PAYE filing again.

No extra work

With PayHero, payday filing becomes part of your regular payroll process. There’s not so much as an extra click required on your part.

Easy set up

With our smart Inland Revenue integration, just connect your PayHero account to myIR once and you’re done. It’s as easy as that.

What is payday filing?

Payday filing was introduced in 2019 as a compulsory new way of reporting employment information that requires employers to submit PAYE information to Inland Revenue within two days of paying staff.

PayHero integrates with Inland Revenue so payday filing is automatically completed with each pay run.

Dignity - Social Enterprise

"With PayHero, our payroll is now as easy as 3 clicks! It’s all integrated with IRD, Xero, and employee timesheets, so it’s incredibly quick and simple."

The Source Bulk Foods - Retail

"With 26 staff across three stores I can run pays and manage tax compliance in about 5 minutes each week without needing a payroll clerk."

How to do payday filing with PayHero

Get started with payday filing in three easy steps.

1. Head to Manage > Integrations in PayHero.

2. Click to connect to Inland Revenue.

3. Securely login to myIR and authorise the connection with PayHero.

Automate your payday filing now

Don’t waste your time with the extra admin - let PayHero handle that for you.

14 Days Free · First Pay Walkthrough · No Credit Card Required

Payday filing FAQs

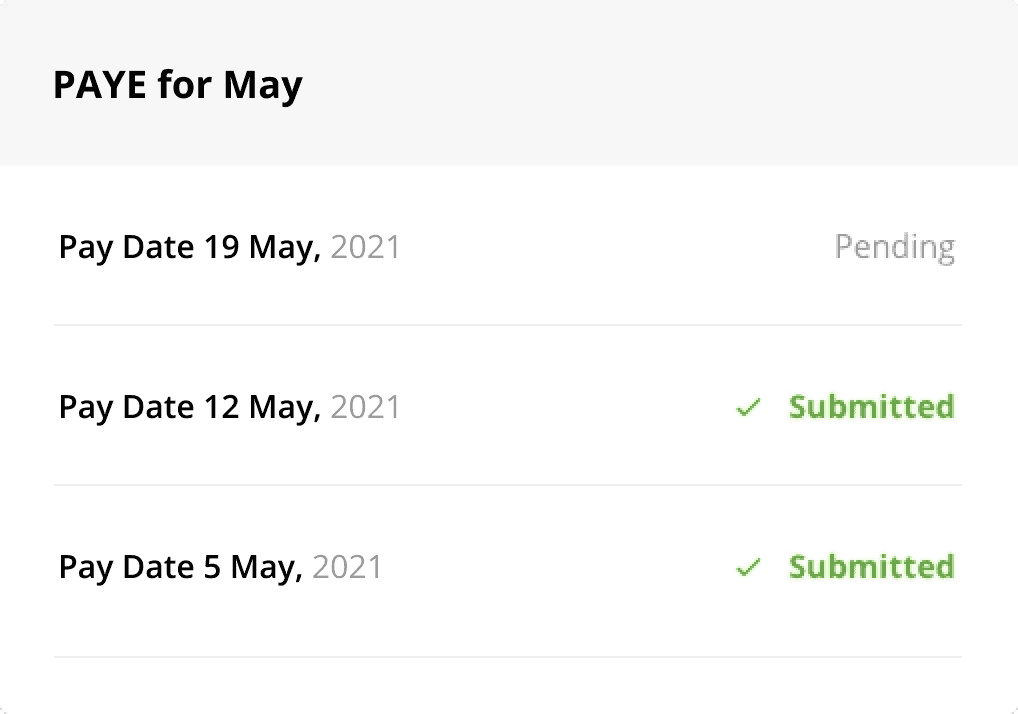

How does payday filing work in PayHero?

We’ve developed a direct integration with Inland Revenue so we can submit your tax returns electronically.

Simply connect your account to myIR once and your payroll filing will be taken care of automatically when you finalise each pay. There’s no need to manually file anything via myIR.

Do I need to contact IRD to get set up?

No. As long as you have a myIR account for your company you can connect to that directly from PayHero and authorise payday filing without talking to IRD. New companies need to contact IRD to register as an employer and get a new myIR account set up.

Does payday filing cost extra in PayHero?

No. Payday filing is included in the PayHero pricing.

A better way to payroll

Pay your employees accurately and on time with PayHero's easy to use and 100% IRD compliant online payroll software.

Trusted Payroll

Trusted by thousands of NZ companies, PayHero is fully compliant with payroll and holiday laws and automatically works out pay, taxes, holidays and leave.

Mobile Apps

It’s easy to capture employee hours straight into payroll with our employee mobile app, or by clocking staff in and out with our photo time clock app.

Online leave management

Employees can see their leave balances and request leave online. Managers can approve or decline the request from an email. It couldn’t be easier.

Xero integration

Our powerful Xero integration lets you send payroll data straight to your chart of accounts with advanced cost tracking options and fast reconciliation.

Take the next step with PayHero

Join thousands of Kiwi companies doing payroll better.

14 Days Free · First Pay Walkthrough · No Credit Card Required