Team Management

How to Set Up Workride in Payroll: NZ’s Ride-to-Work Benefit Scheme

January 31, 2024

Deductions are a part of every employee's pay - for example PAYE, student repayments and KiwiSaver contributions. However, did you know there are other deductions that employers and employees can both enjoy? Our friends at Workride are a great example.

What is Workride?

Workride is a free scheme for businesses, providing a more affordable way for employees to commute to work. Employers can offer their employees the ability to purchase a new bike or scooter, with no upfront costs and a 32-63% discount on the overall price.

Similar cost offset programmes have been very successful overseas, so we are excited to see one here on New Zealand shores. Essentially, after the employee finds and picks up a bike or scooter from an authorized retailer, the employer settles the invoice and recoups the cost through salary sacrifice. Employers benefit from a healthier workforce, and their employees get a new ride without any up-front costs. We are a big fan of what Workride is doing - it’s good for company culture, our bank accounts, and the planet.

How does it work?

Onboard your company to the scheme

Promote it to your employees

Employees choose a new ride

Employers approve the ride and pay the upfront cost

Employees pick up the ride & pay it off over 12 months via a salary deduction, which is subject to an FBT exemption

The savings estimator can help employees learn how much they will save by swapping out taxed income for a new ride. The cost of the ride is taken from their pre-tax salary, lowering their taxable income.

As a quick example, John earns $80,000 a year, has no Student Loan, and contributes 3% to KiwiSaver. As part of the scheme, he chooses a bike worth $4000.

The salary sacrifice is $4000 pre-tax, which is equivalent to $77/week for 52 weeks pre-tax.

With a lower taxable income, and therefore reduced deductions, John’s take-home pay impact will be $2499 which is $48/week for 52 weeks (lease period).

This is a total offset of -$1501, or 38% off the sale price through using Workride.

To sum up, John sacrificed $4000 pre-tax for the e-bike, but it only cost him $2499 thanks to the tax savings and cost offset. Check out the Workride website for more comprehensive information and FAQs.

Where does PayHero come in?

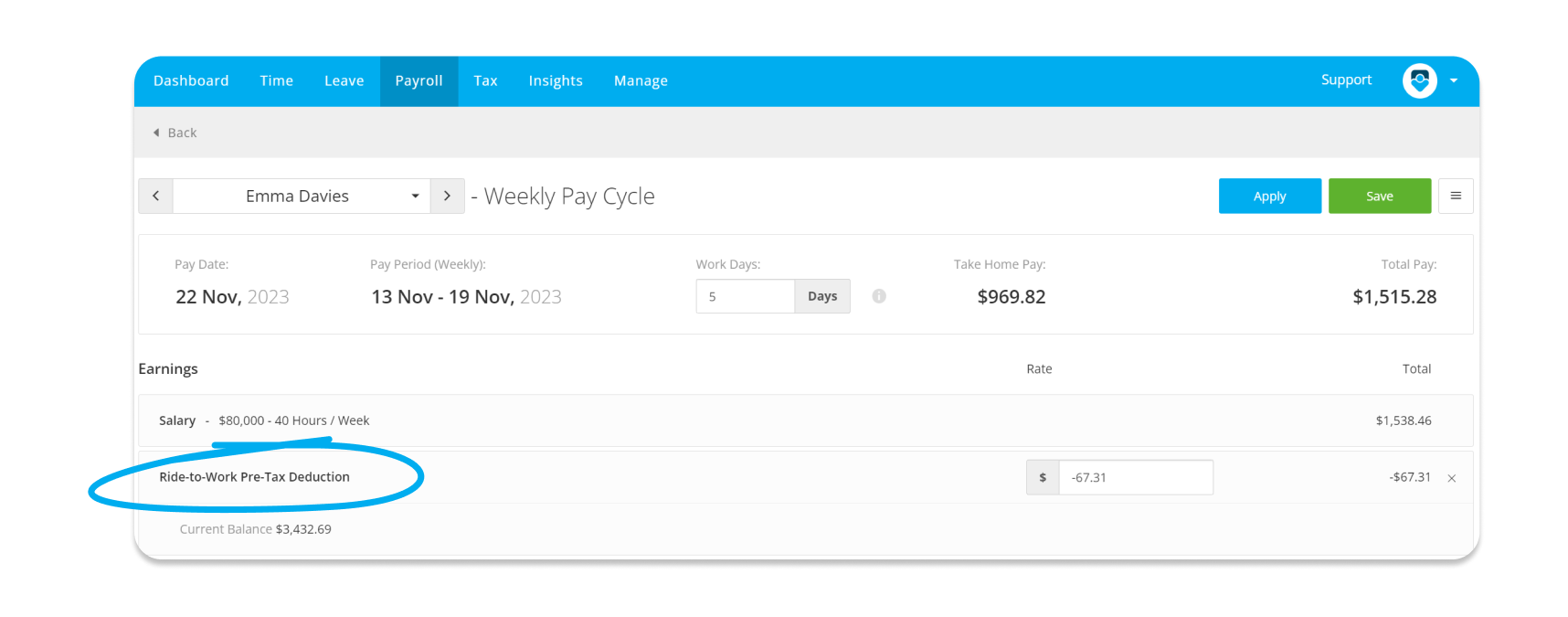

To process Workride deductions in PayHero, contact our awesome Support team who will get a pay item set up in your account. Due to custom settings needed in the background, we’re happy to take this step off your hands to make sure everything is calculated correctly. Once the deduction is good to go, start recovering the funds by adding it to the Employee’s Default Pay. To protect you, if an employee leaves within the initial 12 months, the outstanding balance must be repaid from their net pay or via a separate top-up.

You can find all the details in this support article. Come along for the ride as more businesses discover this beneficial scheme.