Payroll & Finance

Get ready for the EOFY | April 2024 Payroll Changes

February 26, 2024

A new financial year is on the horizon, and with that comes payroll and tax changes for Kiwi businesses. The following rates and thresholds will become effective on Monday, 1st of April 2024.

Minimum Wage Changes

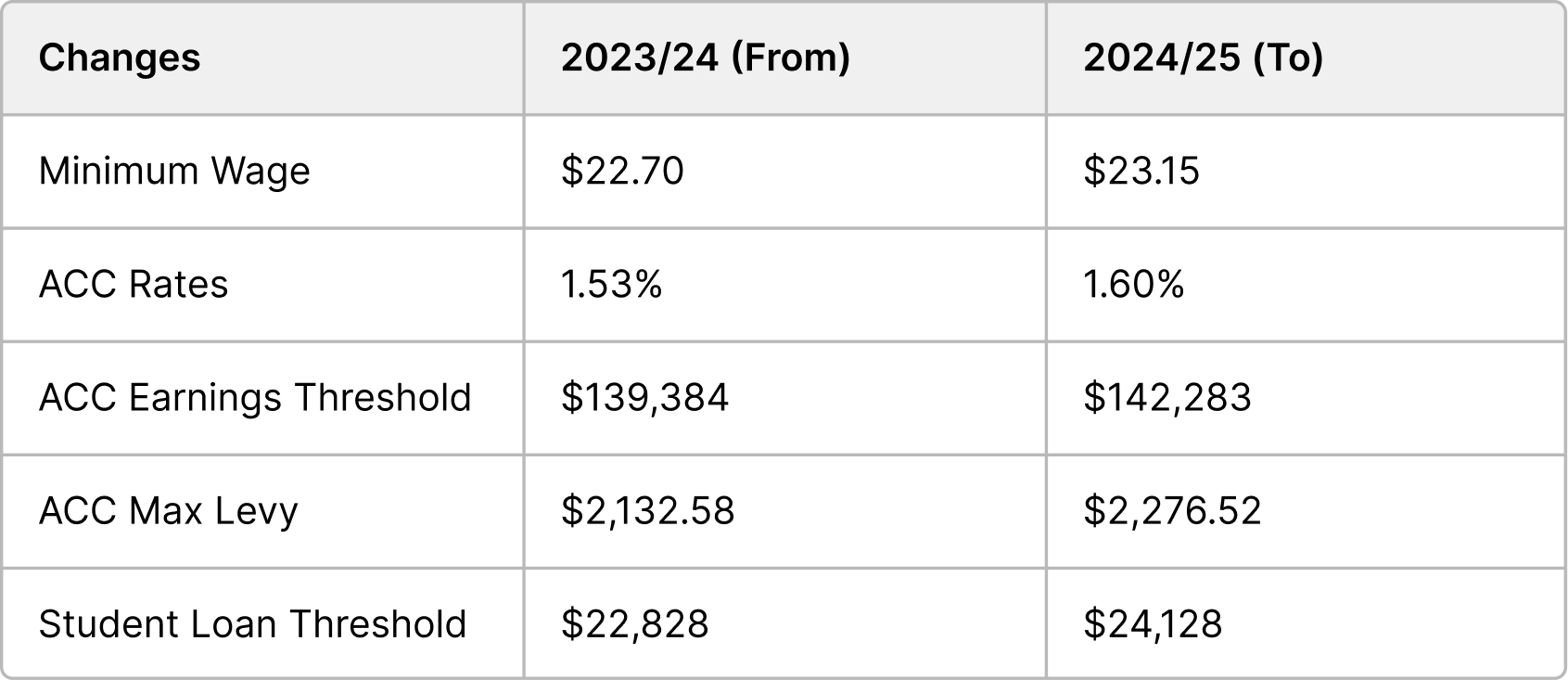

Up to 145,000 employees are currently being paid minimum wage in New Zealand. These employees can expect to make $0.45 more an hour, as the minimum wage is going up from $22.70 to $23.15 per hour.

The starting out and training minimum wage will also increase from $18.16 to $18.52 per hour.

If you have employees on the minimum wage, starting-out wage or training wage, make sure you update their pay rate in your payroll system. If you’re using PayHero, it’s easy to change pay rates, even in the middle of a pay period. When applicable, you can also apply a Minimum Wage Top Up to an employee’s pay.

ACC Earners Levy Rate and Thresholds

From 1 April 2024, employees may notice a little more deducted from their wages to cover the increase of the ACC Earners Levy. This change will also apply if you’re self-employed, a shareholder-employee or contractor.

ACC Earners’ levies rate will increase from $1.53 to $1.60 per $100 earned, or 1.60%, inclusive of GST.

The maximum annual threshold for liable earnings that self-employed and businesses pay Work Account levies on will also increase from $139,384 to $142,283.

PayHero users won’t need to change anything manually in the system as we do it all for you. However, if you’re paying employees using automatic payments set up directly with your bank, you’ll need to adjust these to accommodate the new rates. This isn’t necessary if you’re using PayHero’s Pay Now or Bank Batch files. Read more in our ACC payroll guide.

Student Loan Repayment Threshold

On April 1 2024, the annual student loan repayment threshold will increase by $1,300, from $22,828 to $24,128. This means for a weekly pay period (divided by 52), the threshold will be $464. After this, an employee will need to pay back their student loan.

For primary income, the Student Loan repayment rate will remain at 12% per every dollar over the repayment threshold. For secondary income, the rate will be 12% on every dollar earned as the repayment threshold does not apply.

PayHero will automatically calculate student loan deductions if an employee has been set up with a tax code ending in 'SL'.