Payroll & Finance

What is Payroll Compliance?

July 17, 2020

There’s a common tax joke that goes, “For every tax problem there is a solution which is straightforward, uncomplicated… and completely wrong”.

New Zealand certainly seems to have taken the joke to heart, with our legislation governing payroll ranking among some of the most complex in the world*.

Some payroll applications claim to be compliant in a way that suggests they’ve passed some sort of official accreditation. The truth? There’s no such thing.

Inland Revenue publishes a suite of test cases, but there’s no onus on providers to run these tests through their software. Also, the tests don’t cover the more complex tax calculations such as bonus payments and final pays.

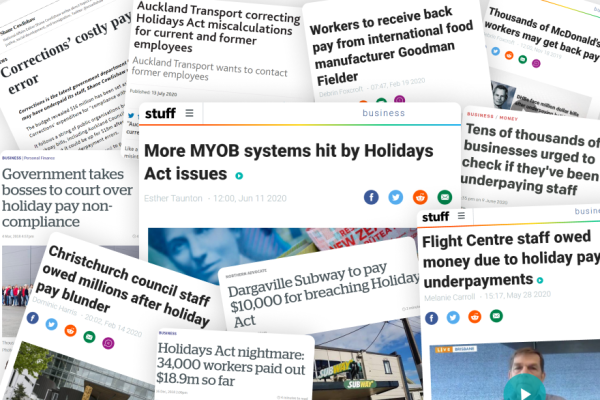

When it comes to the Holidays Act, easily the most complex part of running payroll in New Zealand, there are no similar test cases, or any other way for a provider to check or prove their calculations.

Holidays Act compliance

For all its complexities, when it comes to annual leave, the Holidays Act is based on two straightforward principles. Firstly, employees get four weeks of paid leave for each year of continuous employment. Secondly, when they take that leave, those employees must receive what they would normally be paid if they were working.

The Holidays Act only refers to weekly balances for annual holidays. In practice, most NZ payroll systems manage annual leave in hours (72% according to a 2014 Simpson Grierson survey), and many of the remaining systems use days.

Widespread underpayment issues have arisen because most of these systems “accrue” leave as employees work, either based on the hours worked each week, or on a fixed ‘normal hours per week’ agreed when the employee first started.

Over the years this approach has become the de facto standard, and is now the way that most employers and employees think about annual leave. The problem is that when an employee’s work pattern changes, their entitlement to four weeks of paid leave for each year of employment may not be met.

For example, if an employee works 10 hours per week over a year they’ll have accrued 40 hours leave, which, as long as their work pattern doesn’t change, would allow them to take four weeks off. But if their work pattern does change and they’re now working 40 hours per week, those hours accrued in the previous year would only pay for one week of leave. After taking a single week off their leave balance would be 0.

New guidance from MBIE

In 2017 the Ministry for Business, Innovation & Employment (MBIE) released a detailed 98-page document providing guidance on annual holidays, domestic violence leave, bereavement leave, alternative holidays, public holidays and sick leave.

This guidance document provided clarification on many parts of the Holidays Act that have historically been a bit vague, or open to different interpretations. Most importantly, it specifically discourages the practice of accruing leave based on the hours or days worked by an employee.

“It is strongly advised that annual holidays balances are kept in weeks. This will reduce the risk of non-compliance. Keeping balances in units other than weeks can lead to non-compliance if work patterns change.” p.32

If you’re using a system that accrues leave in hours or days you’ll need to do extra work on an ongoing basis to ensure your employees receive the correct leave entitlements.

Every time an employee’s work pattern changes you’ll need to update the normal hours per week for the employee, update any existing leave balances to reflect the new pattern, and update the employee’s pay history for the past 12 months.

It’s a fair bit of manual work, requires significant payroll knowledge and there’s a high chance of making an error. The better option is to choose payroll software that keeps annual leave balances in weeks.

How compliant is your payroll? Questions to ask yourself (or your payroll provider).

Timesheet & recordkeeping compliance

Compliance also varies between systems when it comes to record keeping. As an employer, you must keep wage and time, and holidays and leave records that comply with the Employment Relations Act 2000 and the Holidays Act 2003.

In particular, you must be able to show that you’ve correctly given your employees all minimum employment entitlements such as the minimum wage and annual holidays. Check out MBIE’s full list of records that you must and should keep for each employee.

According to MBIE, these recordkeeping requirements are needed to show a clear picture of each day in an employee’s working year. “That is, which days were worked, not worked, on leave and what type of leave, and so on. This information is used to calculate different types of pay for such leave as annual holidays or sick leave, and entitlements such as parental leave.”

Where an employee’s hours vary from day to day this means keeping detailed timesheets. It’s not uncommon for payroll software to only record the total hours for a week, without a record of how many hours were worked on each day. Unless you have this information in a separate time and attendance solution, or are keeping boxes of paper timesheets stored away somewhere, you’re not complying with the legislation.

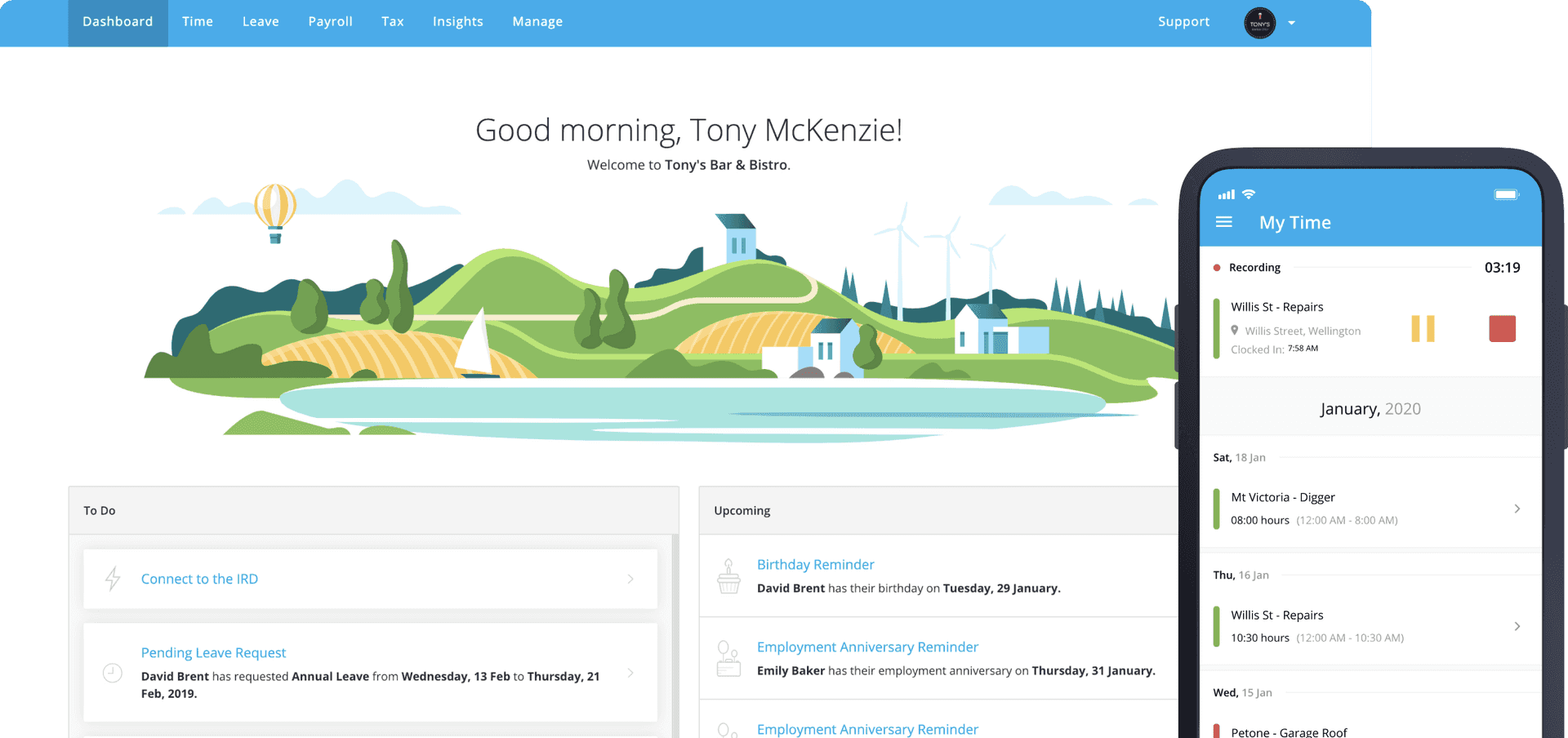

PayHero’s online timesheets and associated tools for capturing time are a great solution to this regulatory requirement. As well as providing accurate average rate calculations, PayHero can use this extra information to automate the handling of public holidays.

The moral of the story? Compliance is positively snooze-worthy, time consuming, and deeply complex – so why not let PayHero handle it for you?

* NGA HR Research – Payroll Complexity Index 2013