Payroll & Finance

A Guide to Public Holiday Payroll - How to Get it Right Every Time

Public holidays. We all love them, right? Well, most of us do... I suspect there are a fair few business owners and payroll managers out there who secretly dread those 12 days a year that the rest of us can’t wait for.

That’s because public holiday payroll calculations can be painful. Especially for those of you who have to manually figure out what everyone is owed. We’ve heard more than a few stories of businesses that spend a day or more after every public holiday trawling back through old timesheets and pay records with a calculator in hand.

So we thought: how can we help? This ten-point guide provides a short but sweet summary of how to process public holiday payroll in New Zealand.

1. Public Holidays in New Zealand

There are a range of national public holidays in New Zealand, they include:

New Year’s Day

Day after New Year’s Day

Waitangi Day

Good Friday

Easter Monday

Anzac Day

King's Birthday

Matariki

Labour Day

Christmas Day

Boxing Day

Regional anniversaries are also celebrated throughout the country at different times of the year. For more information about national and regional holidays, the government has an extensive list here.

2. Helpful Public Holiday Lingo

Public Holidays require some different calculations to your average day and there are some funky terms to describe how this is done.

Here are a few handy definitions for you:

Otherwise Working Day (OWD): If the day had not been a public holiday, would the employee have been at work? If yes, it’s an OWD. If no, it’s not. Not sure how to figure this out? There’s no strict definition, but a rule of thumb recommended in the Holidays Act Review is if an employee has worked 50% or more of the corresponding days in the previous four or 13 weeks then it is an OWD for them. And when in doubt, the Department of Labour has this calculator to help you figure it out.

Relevant Daily Pay rate: What an employee would have earned if they had been at work that day, including any additional earnings such as commission. If the relevant daily pay rate is known, this should be used.

Average Daily Pay rate: For employees with irregular work patterns it may be impossible or impractical to determine what they would have earned on any given day. If that’s the case, then the average daily pay may be used instead. This is the employee’s earnings over the last 52 weeks, divided by the number of days they’ve worked in the last 52 weeks.

Alternative Day: This is an additional day of leave that is accrued by an employee when they work on a public holiday that is an OWD for them. It is also often referred to as a Day in Lieu. The employee and employer must agree on when this will be taken, and if the alternative day hasn’t been used after 12 months they can cash it in. Employees will usually be paid their normal rate for this alternative day.

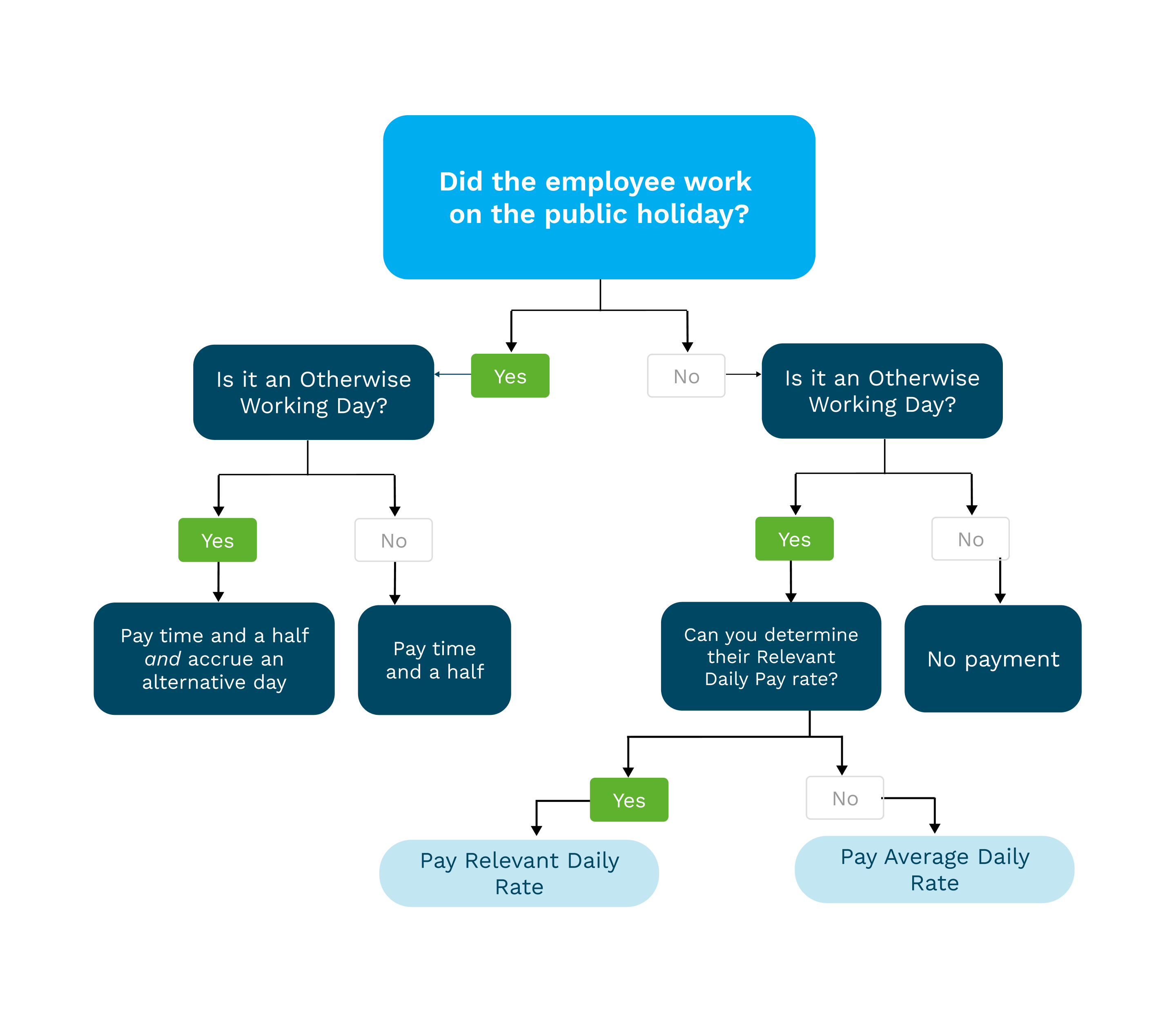

There are a lot of moving parts and potential landmines, but we’ve distilled a handy little chart for you to refer to that we hope will make your life much easier after the next public holiday.

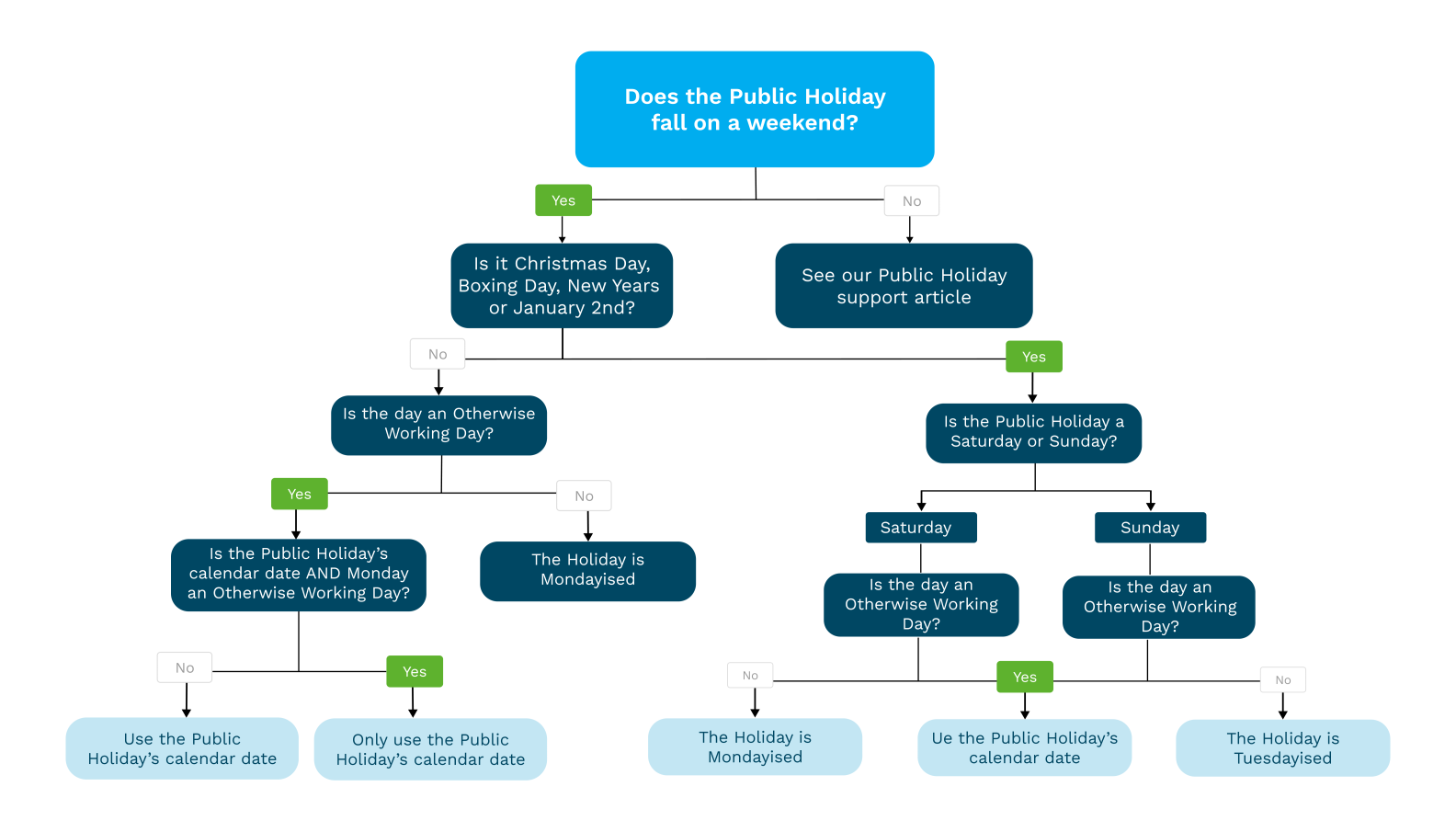

3. What To Do When Public Holidays Fall On a Weekend

Every so often, public holidays will fall on a weekend. When this happens these holidays are usually Mondayised and/or Tuesdayised. Essentially, if you don’t work on weekends and Saturday is a public holiday, then the following Monday is treated as your holiday. If both Saturday and Sunday are public holidays then the Sunday will be Tuesdayised.

This flowchart is a great tool for figuring it all out:

Unfortunately not every public holiday is eligible for Mondayisation. Check out this Mondayised Holidays blog post for more info and to find out which holidays qualify.

4. Paying fixed vs variable employees

A good payroll system will calculate public holidays for both salaried employees and irregular employees automatically, if their work pattern is accurate. However, if it’s still not clear if a public holiday is an Otherwise Working Day for a variable hour employee, then it’s up to the employer to act in good faith and reach an agreement with them. You can read more about this on page 14 in the latest Holidays Act Guidance published by Employment New Zealand in 2017.

5. Processing annual leave that falls on a public holiday

Employees are still entitled to public holidays when taking annual leave. If the holiday is an Otherwise Working Day for them then they will be paid out at the appropriate pay rate and it will not count as a day of leave. This still applies if an employee has left the company and their outstanding annual leave falls on a public holiday.

6. Processing sick leave that falls on a public holiday

When an employee is sick on a public holiday they receive a paid day off and it will be treated as an unworked public holiday rather than as sick leave. However, they will not be entitled to time and a half or an alternative holiday.

7. How many hours employees should be paid for

Employers don’t need to pay employees for the whole day if they only work a few hours on a public holiday. Employees will simply receive pay for the hours they actually work.

8. Transferring public holidays

It’s possible to transfer a public holiday to another day if employees request this and it works for your business. In this case, the newly observed day must still be an otherwise working day for the employee and it must be agreed in writing. This might happen if an employee doesn't celebrate Easter or Christmas and wants to transfer the holiday to a day that is more meaningful for them.

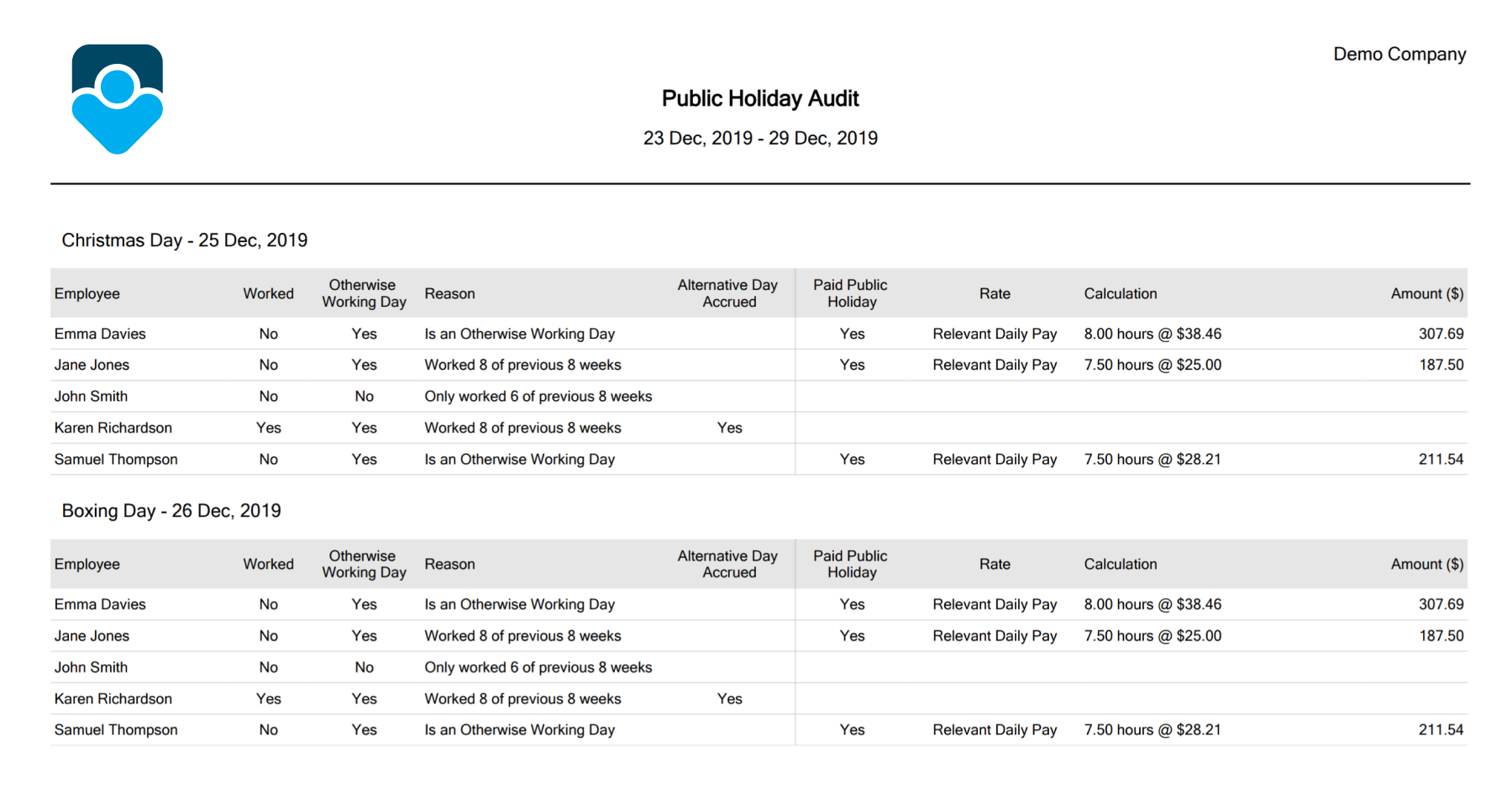

9. Using reports to your advantage

If you feel like you’ve ticked all the boxes on the public holiday pay cycle but want to triple check, then a good reporting system can put your mind at ease. In PayHero, you can download a Public Holiday Audit report before sending a pay to ensure everyone is getting paid correctly.

10. Or just let your payroll system do the heavy lifting…

Of course, you could just set up a PayHero account to take care of things for you with our automated Public Holidays feature and advanced work pattern function. No matter what type of hours your employees work, PayHero will take the right information from their timesheets to calculate public holidays.

If you’re ready to kick back, relax, and start looking forward to public holidays as much as your employees do, simply check out our support article to get things set up.