Payroll & Finance

A Guide to Payday filing – What is it and how will it affect you?

Payday Filing – Available now

After a long period of uncertainty we finally have confirmation that payday filing will be introduced in April 2018 and made mandatory from April 2019. Read on to help understand what it is, how it will impact you and how FlexiTime can help.

What is payday filing?

Part of Inland Revenue’s Making Tax Simpler initiative, as the name suggests payday filing means submitting PAYE returns to IRD after each pay rather than once a month. The due date for paying PAYE and other deductions to IRD won’t change.

What are the benefits?

The main benefit is that you’ll be able to file your returns automatically from your payroll software. It will also become part of your normal payroll cycle, so you won’t need to store your payroll information and remember to file your PAYE as a separate process at the end of the month.

Having more up-to-date information means IRD can work out tax and entitlements more accurately, providing more certainty that companies and employees are paying and receiving the correct amounts throughout the year.

How will it work?

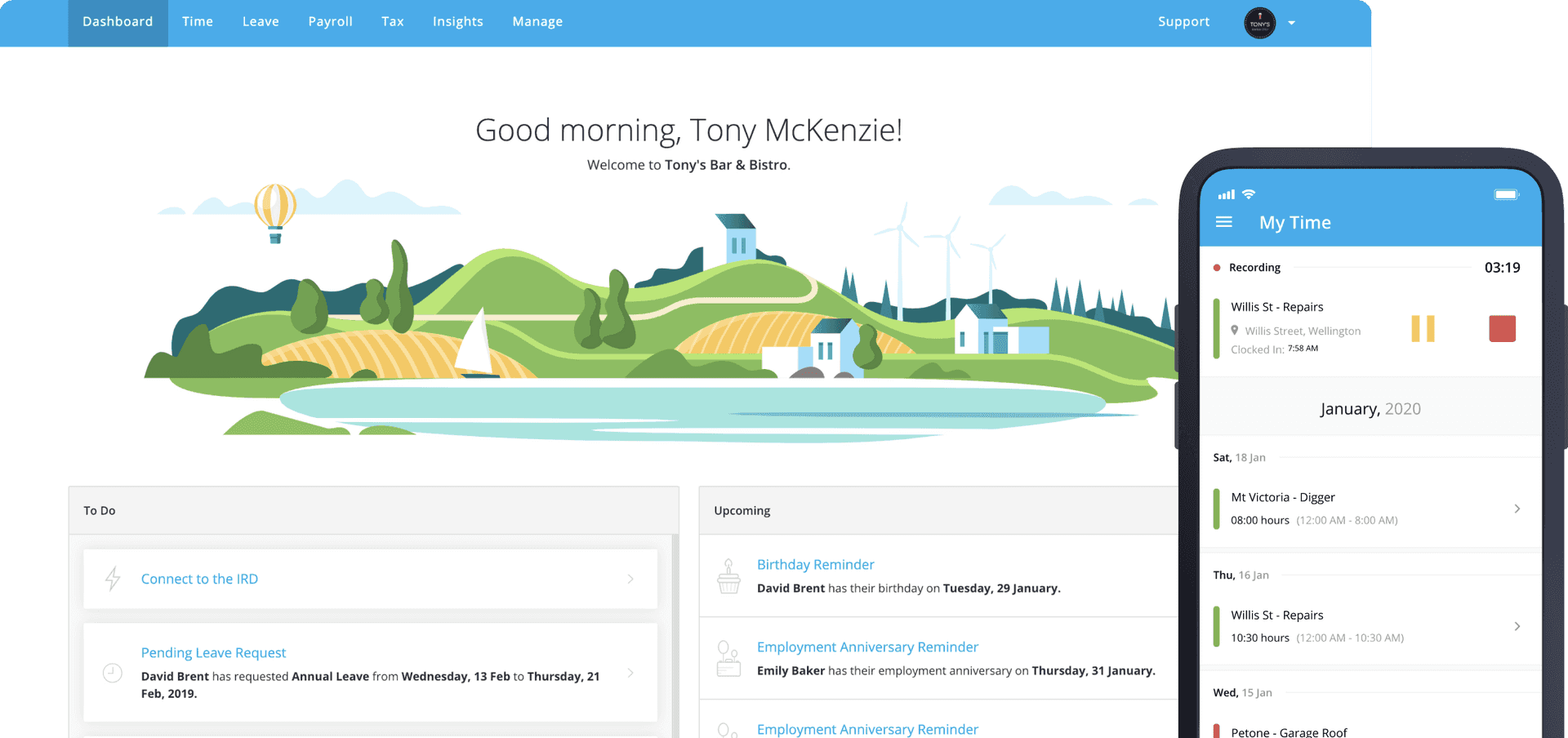

IRD has developed a new software system to collect tax revenue, replacing their decades old legacy system. Online payroll systems like FlexiTime can now connect directly to IRD’s software to submit tax returns for the first time.

This means that PAYE filing, always a manual task up until now, can finally be automated.

Does FlexiTime support payday filing?

Absolutely. In fact, we’re proud to be an early adopter.

Here at FlexiTime we always favour technology solutions over time consuming manual processes. We’ve been working with IRD for months building and testing integration functionally and are among the very first payroll providers to go live with payday filing.

We will be moving all of our PAYE Intermediary customers to payday filing when it goes live on 1st May 2018. We’ll then be offering other customers the opportunity to upgrade in the following months, with all customers using payday filing by the cutoff date of 1 April 2019.

UPDATE July 2018: payday filing is now available in FlexiTime. Check out our payday filing page for info on how to get started.

Other common questions

What do I need to do to prepare?

You’ll need to ensure you’re registered with MyIR – you can do this in advance if you’d like.

When you switch to payday filing you’ll need to authenticate the two systems so they can share information by connecting your MyIR account to FlexiTime. We’ll provide details of how to do this closer to the time.

How long will I have to submit PAYE returns after I run a pay?

Officially you have two days to file PAYE returns. But since this will be happening automatically behind the scenes, it’s not something you need to worry about. On the very rare occasion that there is something wrong with the submission automatically filed for you you’ll be emailed and after correcting the issue, can resend the pay from inside FlexiTime.

Will FlexiTime still offer a PAYE Service?

No. FlexiTime will no longer provide PAYE filing services after we transition all of our intermediary customers to payday filing.

I’m currently using the FlexiTime PAYE Service – what does this mean for me?

We’ll be in touch with everything you need to know. There’s very little change to your current payroll process except that from 1st May you’ll start paying PAYE and other deductions direct to IRD instead of to the FlexiTime Trust account.

If you have further questions about payday filing in PayHero, please email support@flexitime.co.nz.