Payroll & Finance

COVID-19 Payroll Information - 2022 Latest

July 26, 2022

COVID-19 Payroll Information - 2022 Latest

Last updated: 11:30am, 26 July, 2022

The New Zealand Government is still providing support for Kiwi businesses affected by the COVID-19 pandemic. Currently, this includes the Short-Term Absence Payment (STAP) and the Leave Support Scheme (LSS). The Wage Subsidy Scheme (WSS), Resurgence Support Payment (RSP) and the Omicron Support Payment are no longer available.

Apply at the Work & Income website.

The government has also announced an upcoming Cost of Living Payment will be automatically paid to eligible individuals from 1st August. Learn more here.

If you need support with other Covid-19 related payroll matters, please contact our support teams.

Jump to:

Helping Employees Navigate Covid Leave and 7-Day Isolation

COVID-19 Short-Term Absence Payment (STAP)

The COVID-19 Short-Term Absence Payment helps businesses keep paying employees who:

cannot work from home, and

need to stay at home while waiting for a COVID-19 PCR test result

STAP only applies to employees awaiting a PCR result, or those who are self-employed. RAT tests are not included as the results are quick.

There’s a one-off payment of $359 for each eligible worker. You can only apply for it once, for each eligible worker, in any 30-day period (unless a health official or doctor tells the worker to get another test).

Find out more here - COVID-19 Short-Term Absence Payment

COVID-19 Leave Support Scheme (LSS)

The COVID-19 Leave Support Scheme is designed to help businesses pay their staff that can’t work.

It covers employees who;

can't come into work because they are in one of the affected groups and have been told to self-isolate, and

can't work from home.

If an employee or self-employed individual gets COVID-19 again and has to self-isolate, you can apply for the LSS again.

The Covid-19 Leave Support scheme is paid at the rate of $600 a week for a full time employee and $359 a week for a part time employee.

Find out more here - COVID-19 Leave Support Scheme

Helping Employees Navigate Covid Leave and 7-Day Isolation

As stated by the government, employers and employees need to work together to slow the spread of COVID-19, protect New Zealand and keep each other safe. This means that normal obligations for employers to keep in regular contact with their employees and to act in good faith are more important than ever.

Employees must isolate if they’ve tested positive. If they are household contacts and haven’t had COVID-19 in the last 90 days are also required to isolate. Certain essential workers may be exempt.

Contact your employee, so you are fully informed about their situation and ensure they’ve informed the Ministry of Health through the Covid-19 Health Hub online.

If the employee has been working while infected, prior to testing positive, ensure any applicable workspace areas have been cleaned.

If the employee works from home during their isolation period, ensure they have everything they need to do their job.

Inform others in the business if they have been in close contact with the isolating employee. However, by law, the employee’s name must not be shared.

The financial assistance eligible to employees is based on their individual circumstances. Remember that your employee’s pay may look different depending on the type of payment and the timeframe it covers. We’ve addressed top FAQs about administering these payments in PayHero. Click here to read them, particularly what they can expect to be paid and how it may appear on their payslip.

Check-in with your employee and see how they’re doing. Some employees may need more time than the regular 7-days of isolation to recover. In this situation, it’s up to you and the employee to agree if they will take sick leave or unpaid leave. Regular employment law applies in this circumstance.

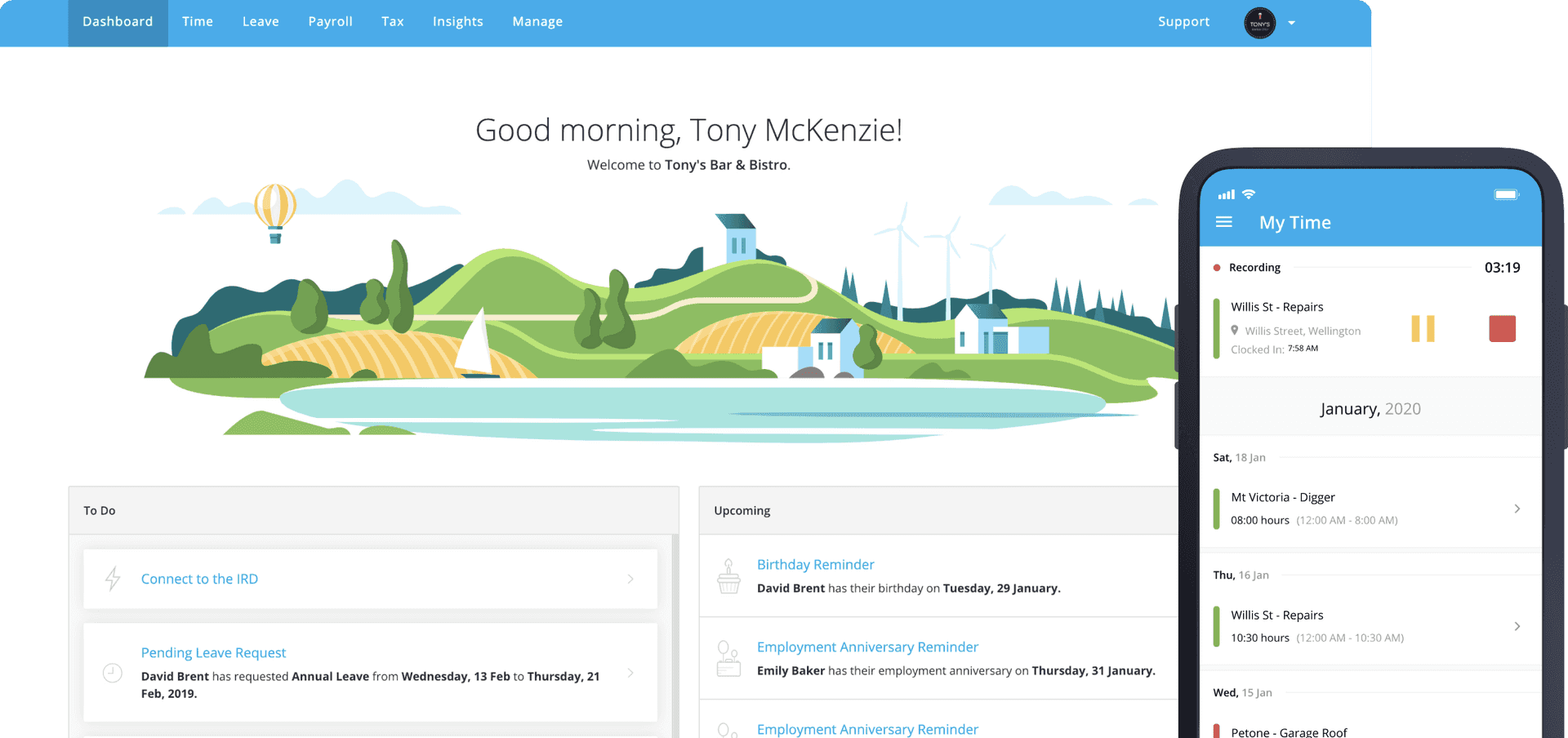

Working with a great payroll system takes the stress out of this situation for employers and employees.

General Government Guidelines

The following workplace guidance has been provided by the government.

Regular employment law still applies to all employment relationships – regardless of the circumstances that we find ourselves in. This includes anything that has been agreed to in an employment agreement.

Under no circumstances can employers pay less than the minimum wage or reduce any of employees’ legal minimum employment entitlements. Employers and employees need to discuss, in good faith, any changes in work arrangements, leave and pay, or health and safety measures.

In the absence of an agreement to alternative working arrangements, employees need to return to work if there is no reason the employee needs to stay away from work under public health guidance from the Ministry of Health.

If a worker is sick with COVID-19, or required to self-isolate, the first consideration for an employer should be to look after people, contain COVID-19 and protect public health. Businesses may be able to apply for the COVID-19 Leave Support Scheme to support their employees.

Employers should not knowingly allow workers to come to a workplace when they are sick with COVID-19 or required to self-isolate under public health guidelines for COVID-19. If they do, they are likely to be in breach of their duties under the Health and Safety at Work Act.

Businesses should check if they are eligible for financial support on the Work and Income website.

Useful Resources

To learn more about processing these payments in PayHero, check out this FAQ article.

Further guidance from the government is available through the links below:

Disclaimer

This information has been provided by the FlexiTime team to help Kiwi employers during the COVID-19 pandemic. Because this is a rapidly changing situation, the information provided is subject to change.

If in doubt, please talk to your accountant, HR advisor or an employment lawyer for further advice.